Generative AI is not the monster, but our Savior!

The global economy is facing three concurrent challenges:

1. Deglobalization: According to the Center for Economic Policy Research (CEPR), COVID-19 has added momentum to the deglobalization trend, which has been further exacerbated by the war in Ukraine. The result is short-term supply chain challenges and longer-term supply challenges.

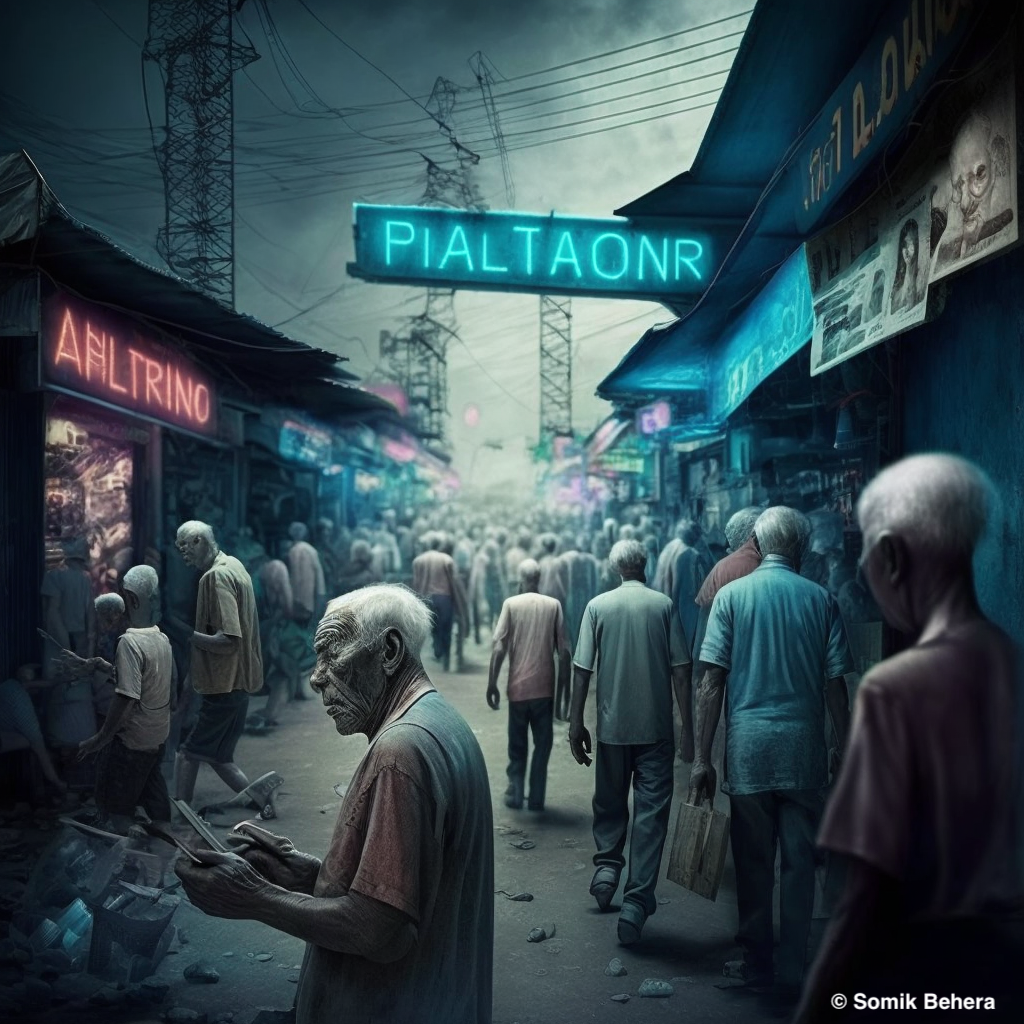

2. Demand Acceleration: While 2022 was the year of "The Great Resignation," as explained by the World Economic Forum (WEF), the greater trend is that the Great Resignation was a catalyst for "The Great Retirement," when the Baby Boomer population will retire. The Great Retirement was estimated to be completed by 2030, but COVID has accelerated it, as found in research conducted by the Federal Reserve Bank of Minneapolis (FedRes, 2022). The net impact of the Great Retirement will be twofold:

1. There will be fewer productive workers available in the US economy, and

2. The boomer retirees will need more services and support from a limited working population. Therefore, we should notice an increase in demand for goods and services from a smaller working population.

3. Supply Decline: Our solution for more goods and services to satisfy the appetite in western markets has been (a) importing goods from China as the world's biggest manufacturer and (b) immigration as a means to meet skills and labor shortages [CFR]. But now, for the first time, China's population is in decline, and more importantly, the global decline in fertility rates has accelerated due to COVID, and we now estimate the global population growth rate will drop below replacement rate sooner than estimated. [VisualCapitalist]

Declining population growth, coupled with a bigger and larger aging population, will present a unique long-term recipe for what I mention below

1. Inflation: Inflation will be the first and natural consequence of the macro trends described above, of reduction in supply and population, coupled with an increase in demand for goods and services. Inflation is here to stay in this new world order.

2. Reduced growth: Declining population growth, coupled with a bigger and larger aging population, will present a unique long-term recipe for:The majority of our world's production follows a capitalistic economic model, and a direct side-effect of inflation in our monetary system is lower investment in growth assets as central banks are forced to offer higher risk-free interest rates to keep inflation manageable. The higher risk-free interest rate means that any growth investments need to generate larger and outsized returns on investments (ROI) to be competitive with central banks' risk-free rates.

3. Reduced R&D Spend Dilemma: While R&D spend to increase productivity is the only way out of the mess we find ourselves in, most companies will take the route of decreasing R&D investments to shore up liquidity in a rising interest rate environment. That said, the daring few who take the chance at this point in time will generate outsized returns as our global economy demands it.

The Long-term Implications

1. Increase in Government Debt: As employment or other crises emerge, like the recently noticed banking crisis in Silicon Valley [WSJ], the collective world governments will be forced to backstop the crisis, even at the expense of increasing global sovereign debt.

2. Increased Taxes: A direct consequence of increased sovereign debt will be increased taxes on the population that is of productive working age (the Gen X, Gen Y, Millennials, & Xennials).

3. Transformative Technology like Generative AI: The final and long-term solution to our problems is going to transformative technology as technology increases productivity and is considered deflationary. Given the inflationary macro headwinds, I am convinced 100x productivity multiplier technology like Generative AI remains our most compelling hope out of the challenging situation we find ourselves in.

The Solution aka what should you do?

In conclusion, generative AI is not the monster that some reports estimate due to the displacement of 300 million jobs but rather our savior. Goldman Sachs estimates that generative AI could raise global GDP by 7 percent [Goldman Sachs, 2023]. As we face these economic challenges, generative AI can provide the productivity boost we need to overcome them.

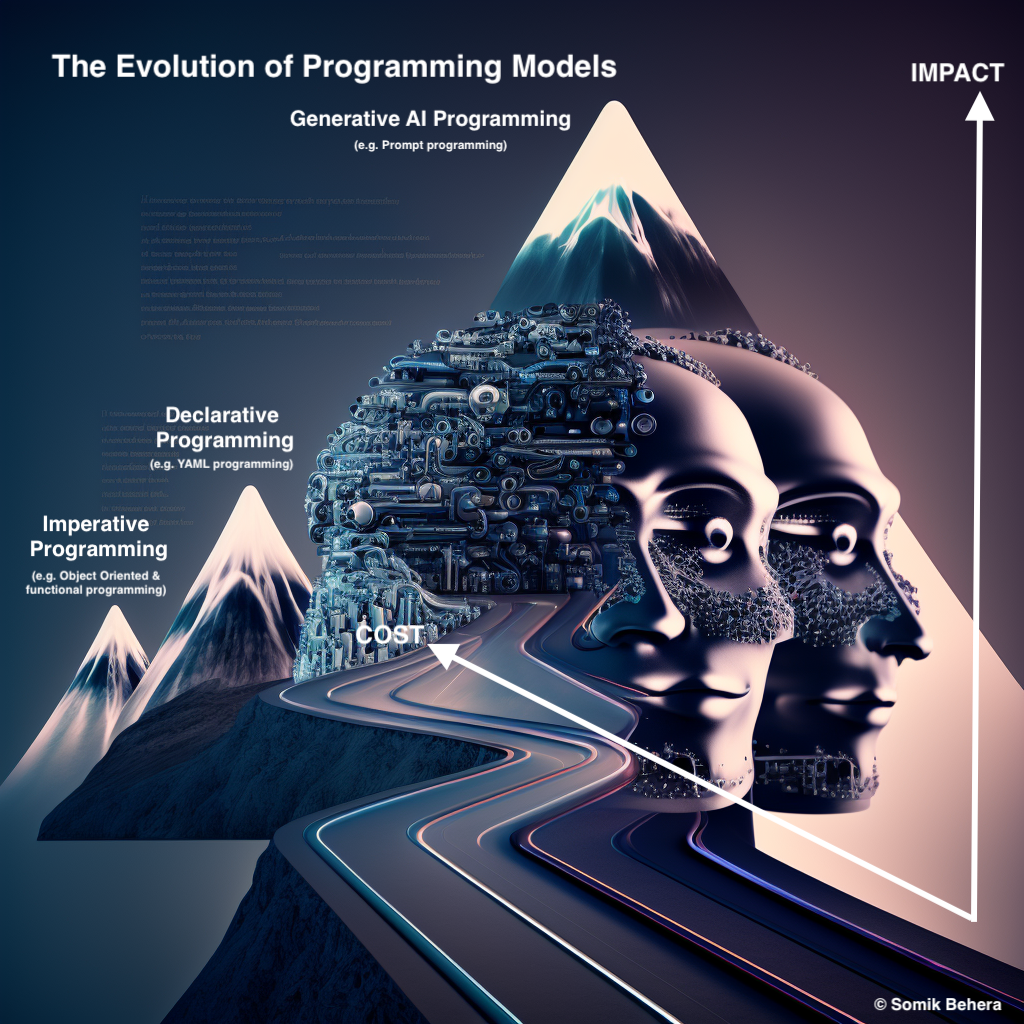

As I had mentioned in my newsletter about 4 months ago, the era Generative AI promises a simpler and natural language based programming model (aka prompt engineering) that is low effort and exceedingly high impact. Similar to going to a declarative model from imperative model for CloudOps folks but much much more powerful.

Some things you could do to ensure not only your ability to survive but rather THRIVE in this new era by:

- Embracing Generative AI for your job to turbocharge your productivity

- Using tools and vendors, don't build your own Generative AI capabilities, unless you work for an Generative AI company

- Finally, sign-up for early access to CloudOps CoPilot, that promises bringing the power for ChatGPT and Generative AI to CloudOps, DevOps and FinOps teams

Net-Net: Generative AI is not the monster that Goldman Sachs proclaims, but rather our Savior! [GoldmanSachs]

References

- CEPR, 2020 - https://cepr.org/voxeu/columns/pandemic-adds-momentum-deglobalisation-trend

- WEF, 2023 - https://www.weforum.org/agenda/2023/01/us-workers-jobs-quit/

- FedRes, 2023 - https://www.minneapolisfed.org/article/2022/the-covid-retirement-surge

- CFR, 2022 - https://www.cfr.org/blog/chinas-population-decline-not-yet-crisis-beijings-response-could-make-it-one

- VisualCapitalist, 2022 - https://www.visualcapitalist.com/cp/charted-the-global-decline-of-fertility-rates/

- WSJ, 2023 - https://www.wsj.com/articles/bank-collapse-crisis-timeline-724f6458

- GoldmanSachs, 2023 - https://www.goldmansachs.com/insights/pages/generative-ai-could-raise-global-gdp-by-7-percent.html